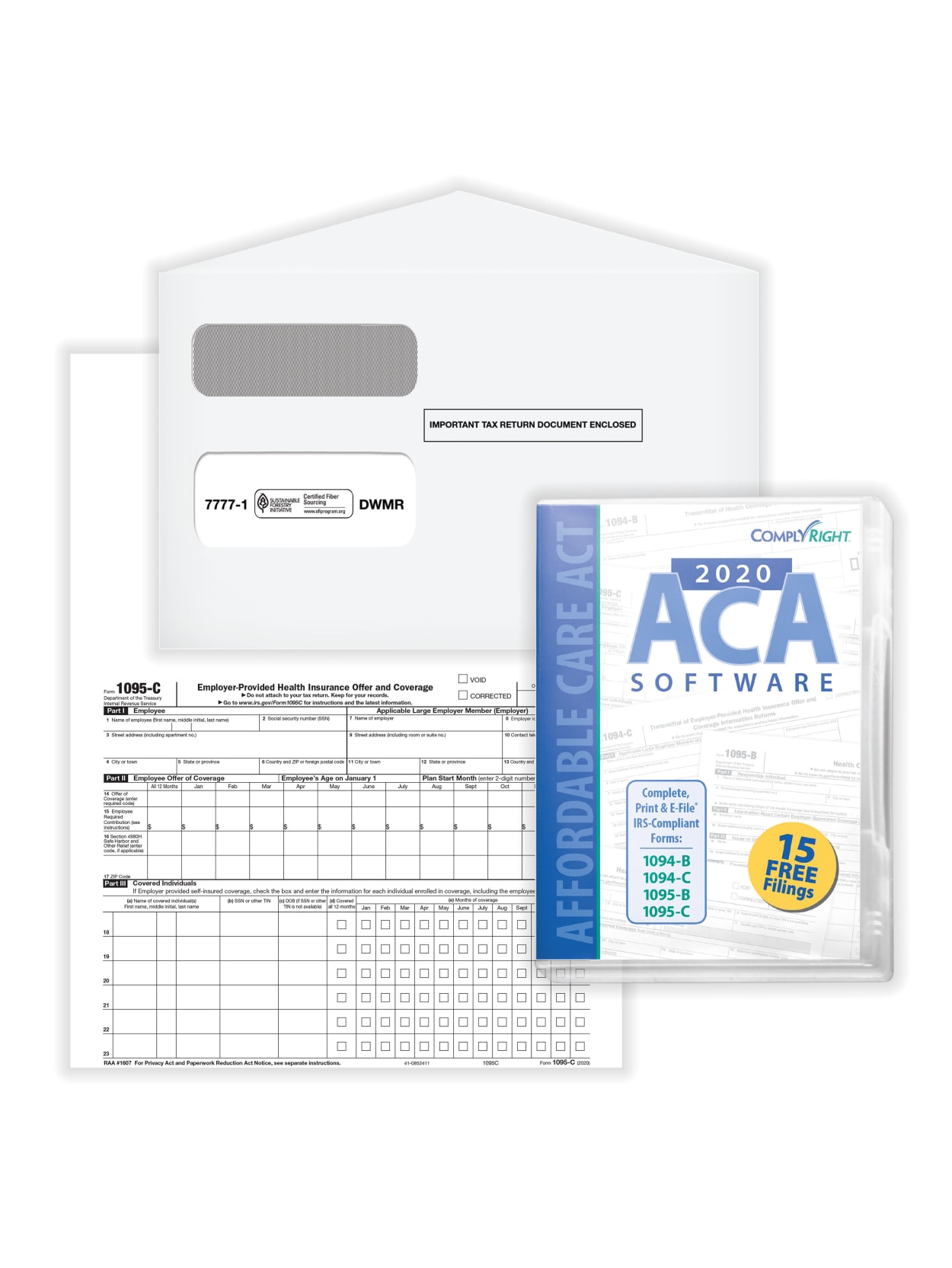

Health Insurance Tax Forms : Have More Than 50 Employees You Need To Know About Aca Affordable Care Act Information Reporting And Irs 1095 Tax Forms Paycheck Manager - Which form you get depends on whether you get your insurance through an employer or buy it yourself.. But you don't need to send the. To do so, it requires certain tax forms as proof of coverage. If you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with your federal income tax return. You do not need a paper copy of this form to file your taxes, as your insurer will file it with the irs on your behalf. The california form ftb 3895 california health insurance marketplace statement.

Tax benefits on a health insurance policy. The california form ftb 3895 california health insurance marketplace statement. This form reports information about your health insurance coverage over the last year. I already filed my taxes for 2015. Show that you were insured so that you don't pay a state penalty for the months you were covered.

/HavenLife-4ae44d7846af46f4b41c8e6331cbaa9e.png)